What is a Tax Clearance Certificate?

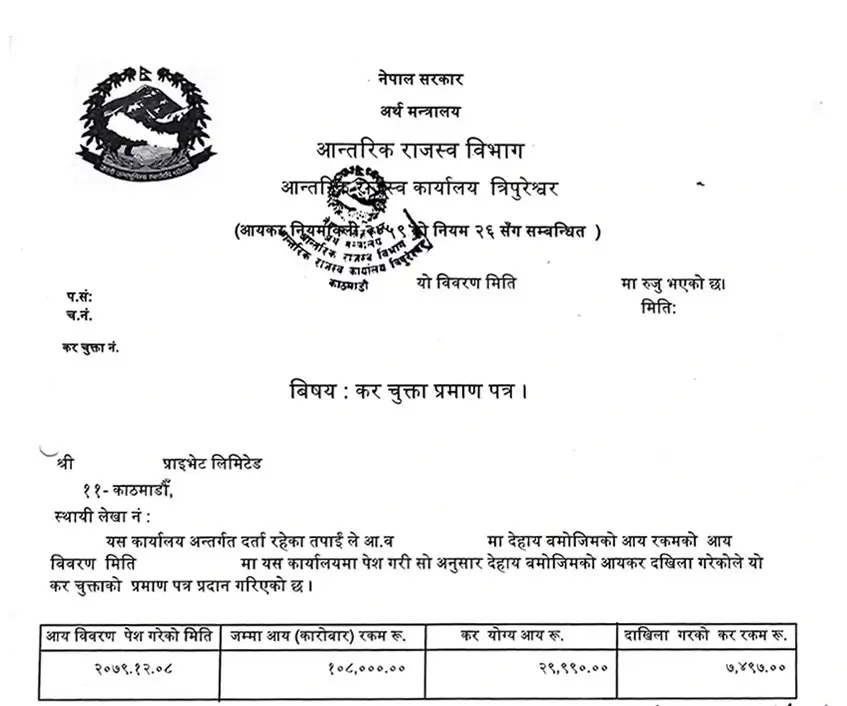

A Tax Clearance Certificate is an official document issued by the Inland Revenue Department (IRD). It confirming that an individual or business has met their tax obligations up to a specific date.

In the Nepali language, it’s called “Kar Chukta” (कर चुक्ता).

Key Points for Understanding Tax Clearance Certificates

Here are some key points to understand about the Nepali tax clearance certificate:

- Purpose: The certificate serves as proof that all tax liabilities have been settled. It is crucial for various situations, such as:

- Business Dissolution: When closing a business, obtaining a tax clearance certificate is necessary.

- Estate Settlement: In cases involving valuable assets, the certificate ensures the proper distribution of assets to heirs.

- Business Ownership Transfer: Buyers of existing businesses may require a sales tax clearance certificate.

- Validity: Tax Clearance certificates remain valid for 12 months from the date of issuance.

How to Obtain a Tax Clearance Certificate in Nepal

Here is a step-by-step guide on how to obtain a Tax Clearance Certificate in Nepal. Follow these four simple steps:

- Step 1: Prepare the audit report and submit income details.

- Step 2: Pay all taxes and TDS.

- Step 3: File ETDS.

- Step 4: Submit an application request for tax clearance certificate with the IRD.